re: tariffs and index investing

I asked ChatGPT how recent tariffs could impact a long-term passive index fund strategy. Not investment advice, but here's what it said:

Really good question, Rishi — and a very thoughtful one too. You're zooming out and asking: does something like a big policy move (tariffs) break the logic of passive long-term investing like in a target date fund?

Let’s break this down with that Vanguard article’s lens in mind + a bit of nuance on tariffs and market dynamics:

🧠 TL;DR:

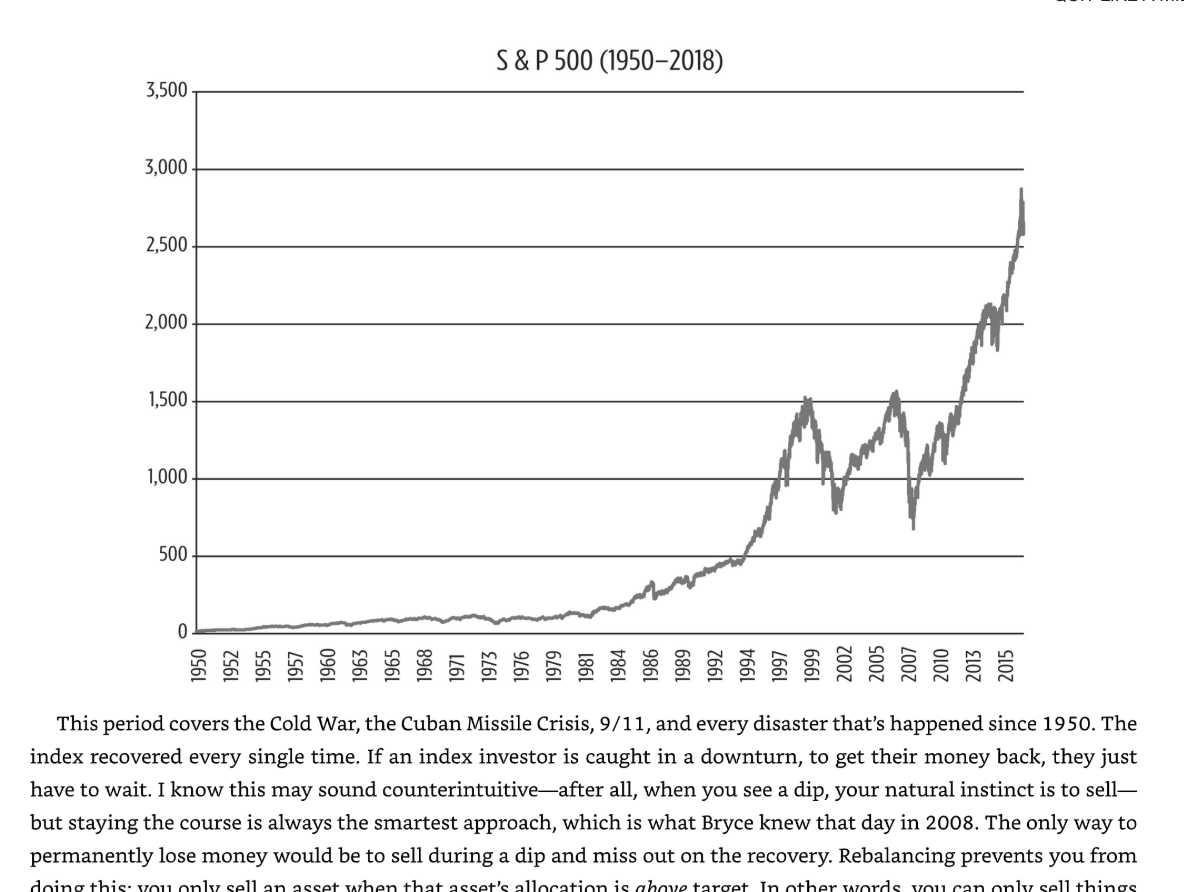

Tariffs like the ones Trump is proposing don’t invalidate long-term investing logic. They may cause short- to medium-term volatility, inflation, and sector-specific impacts, but historically, the broader market adjusts and moves on. So yes, adding more to a target date fund during downturns still fits the "buy low, stay chill" strategy.

🔍 What tariffs actually do:

- Raise costs on imported goods, which can cause:

- Higher prices for consumers (aka inflationary pressure)

- Reduced profits for companies that rely on imports

- Potential retaliation from other countries (hurting exporters)

These effects are real, but they mostly:

- Affect specific sectors (e.g., industrials, manufacturing, retail, tech hardware)

- Often get priced in early by markets (expectations move stocks, not just actual tariffs)

- Don’t necessarily break long-term economic growth

🧾 What the Vanguard article reminds us:

“Markets respond quickly to new information. By the time you react, it may be too late.”

They’re saying: trying to time geopolitics or policy changes like tariffs is a losing game. Because markets are forward-looking, a lot of this volatility is already baked in. Trying to zigzag around it often results in buying high and selling low — the opposite of what you want.

💸 So should you invest more now in your target date fund?

If you have:

- A long time horizon (10–30 years),

- A consistent strategy (i.e., you’re not panicking),

- And some cash on the sidelines that you won’t need soon…

Then yes, this could be a good opportunity to stick to your plan and even buy more. Think of it like a long-term sale. The index fund will recover and keep growing unless there's a total breakdown in the global economy — and even then, it's hard to predict who wins in such a world, so you'd still be better off diversified.

🤏 The one nuance to consider:

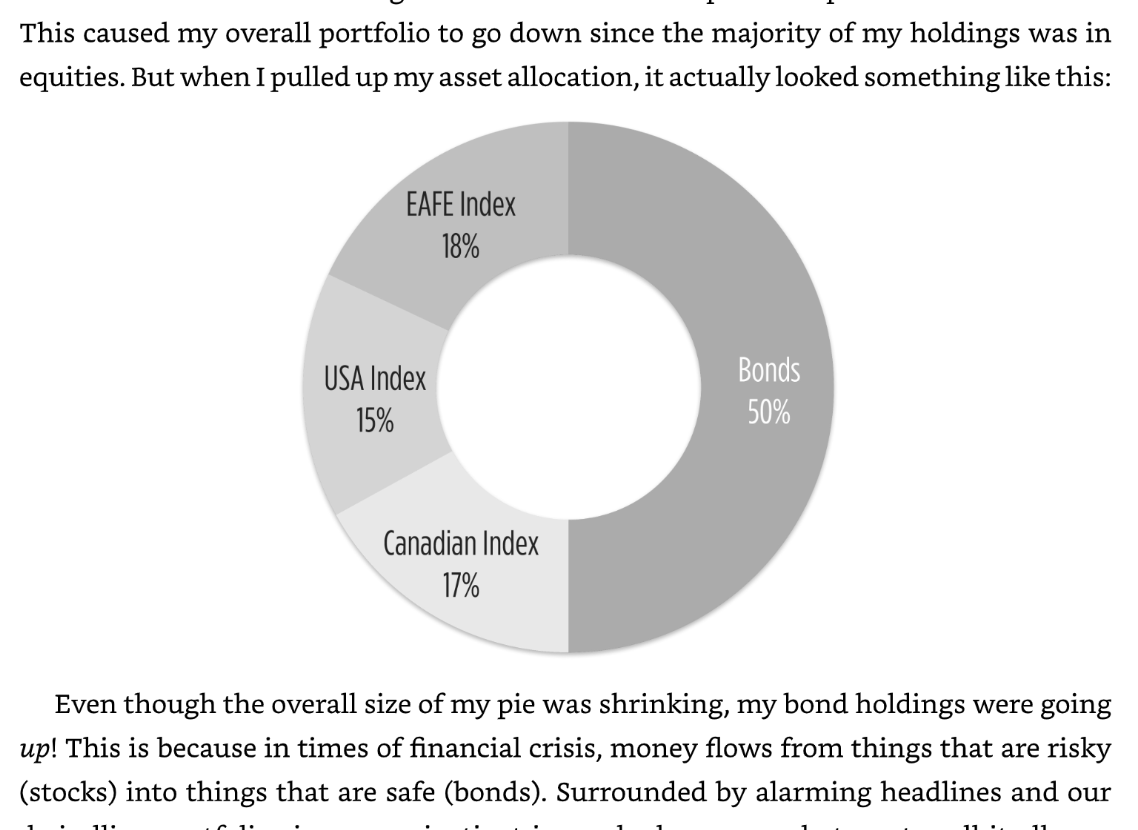

If tariffs escalate into something systemic — like a full-on trade war or a collapse of global trade flows — that could weigh down long-term GDP growth. But even then, you’re not betting on just one country with a total market index fund. You’re spreading across thousands of companies worldwide, many of which can adapt, innovate, and grow regardless of tariff noise.

🔚 Bottom line:

Your strategy of riding out volatility with a target date fund is still valid — and may even work better during turbulent times if you keep adding while prices are low.

As Vanguard would say:

📈 Stay the course. Ignore the noise. Trust the plan.

If you want to go extra deep, I can help you estimate how a global trade slowdown might affect GDP projections and index returns — but for most long-term investors, the best move is honestly… to chill.

Me again. Here's also some screenshots that seem relevant (from this book):

Member discussion